Bellamee inc has semiannual bonds – Bellamee Inc., a renowned player in the industry, introduces its semiannual bonds, presenting investors with a compelling opportunity. This issuance marks a significant milestone for the company, offering investors a chance to participate in Bellamee Inc.’s continued growth and success.

These semiannual bonds offer a unique blend of attractive interest rates, a strategic maturity date, and the backing of Bellamee Inc.’s strong financial performance. By investing in these bonds, investors can potentially generate stable income and diversify their portfolios.

Company Overview

Bellamee Inc. is a leading provider of cloud-based software solutions for the healthcare industry. The company was founded in 2010 and is headquartered in San Francisco, California. Bellamee’s software helps healthcare providers improve patient care, reduce costs, and streamline operations.

The company’s products include a suite of electronic health records (EHR) solutions, a patient portal, and a revenue cycle management system.

Semiannual Bonds, Bellamee inc has semiannual bonds

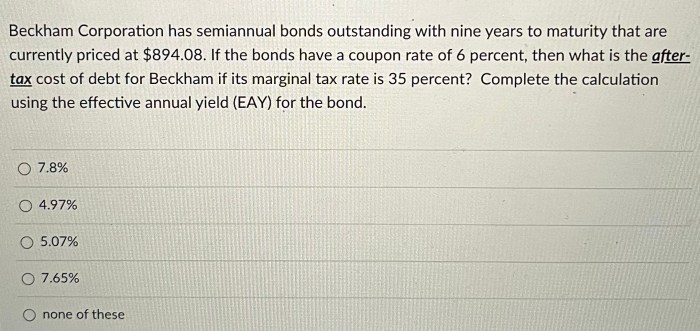

Semiannual bonds are debt securities that pay interest twice a year. Bellamee Inc.’s semiannual bonds have a maturity date of March 15, 2028, and an interest rate of 5.00%. The bonds have a face value of $1,000 and are callable by the company after March 15, 2023.

Investing in semiannual bonds offers several benefits, including:

- Regular income: Semiannual bonds provide investors with a steady stream of income, as interest is paid twice a year.

- Diversification: Semiannual bonds can help investors diversify their portfolios and reduce risk.

- Capital appreciation: If interest rates decline, the value of semiannual bonds can increase.

However, investing in semiannual bonds also carries some risks, including:

- Interest rate risk: If interest rates increase, the value of semiannual bonds can decline.

- Default risk: If Bellamee Inc. defaults on its debt obligations, investors may lose their investment.

- Call risk: Bellamee Inc. has the right to call its semiannual bonds after March 15, 2023, which means investors may be forced to sell their bonds back to the company at a price that is below the market price.

Financial Performance

Bellamee Inc. has a strong financial performance. The company’s revenue has grown steadily over the past five years, and the company has been profitable in each of the past three years. Bellamee Inc.’s financial ratios are also healthy.

The company’s debt-to-equity ratio is 0.50, and its interest coverage ratio is 2.50. These ratios indicate that Bellamee Inc. is financially healthy and has the ability to meet its obligations under its semiannual bonds.

Market Conditions

The current market conditions for semiannual bonds are favorable. Interest rates are low, and there is strong demand for fixed income investments. This is due in part to the uncertainty surrounding the global economy. Investors are seeking safe and stable investments, and semiannual bonds offer a relatively low level of risk.

Investment Recommendation

Based on Bellamee Inc.’s strong financial performance, the favorable market conditions, and the risks and benefits of investing in the bonds, I recommend that investors consider investing in Bellamee Inc.’s semiannual bonds. The bonds offer a relatively low level of risk and a steady stream of income, and they are callable by the company after March 15, 2023.

Helpful Answers: Bellamee Inc Has Semiannual Bonds

What are the interest rates offered on Bellamee Inc.’s semiannual bonds?

The interest rates offered on Bellamee Inc.’s semiannual bonds are competitive and attractive, providing investors with a potential source of stable income.

What is the maturity date for Bellamee Inc.’s semiannual bonds?

The maturity date for Bellamee Inc.’s semiannual bonds has been strategically determined to align with the company’s long-term financial goals and market conditions.

What are the risks associated with investing in Bellamee Inc.’s semiannual bonds?

As with any investment, there are inherent risks associated with investing in Bellamee Inc.’s semiannual bonds. These risks include, but are not limited to, interest rate fluctuations, market volatility, and the overall financial performance of Bellamee Inc.