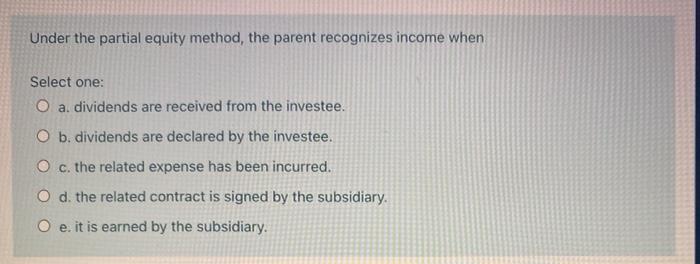

Under the partial equity method the parent recognizes income when – Under the partial equity method, the parent company recognizes income from its investment in the subsidiary when the subsidiary earns net income. This method is used when the parent company has significant influence over the subsidiary but does not have control over it.

The parent company’s percentage of ownership in the subsidiary determines the amount of income that is recognized.

The partial equity method is an important tool for parent companies to use in order to accurately report their financial results. By understanding the concept of income recognition under the partial equity method, parent companies can ensure that they are providing accurate and transparent financial information to their stakeholders.

Partial Equity Method: Income Recognition

Under the partial equity method, a parent company recognizes income from its investment in a subsidiary only when the subsidiary declares and pays dividends.

The parent recognizes income based on the percentage of ownership it holds in the subsidiary. For example, if the parent owns 50% of the subsidiary, it will recognize 50% of the subsidiary’s net income as income on its own financial statements.

Percentage of Ownership, Under the partial equity method the parent recognizes income when

The parent’s percentage of ownership in the subsidiary determines the amount of income it recognizes. The higher the ownership percentage, the greater the amount of income recognized.

For example, if a parent company owns 70% of a subsidiary, it will recognize 70% of the subsidiary’s net income. If the subsidiary’s net income is $100,000, the parent company will recognize $70,000 as income.

Subsidiary’s Performance

The financial performance of the subsidiary also affects the amount of income recognized by the parent company. If the subsidiary is profitable, the parent company will recognize more income. If the subsidiary is loss-making, the parent company will recognize less income.

For example, if a subsidiary has a net income of $50,000, the parent company will recognize $25,000 as income if it owns 50% of the subsidiary. However, if the subsidiary has a net loss of $50,000, the parent company will recognize a loss of $25,000.

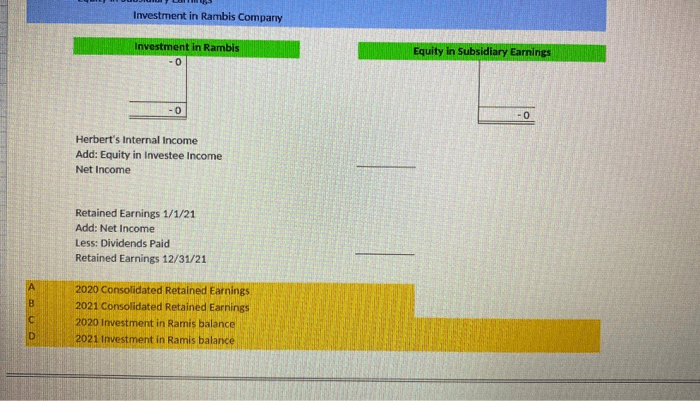

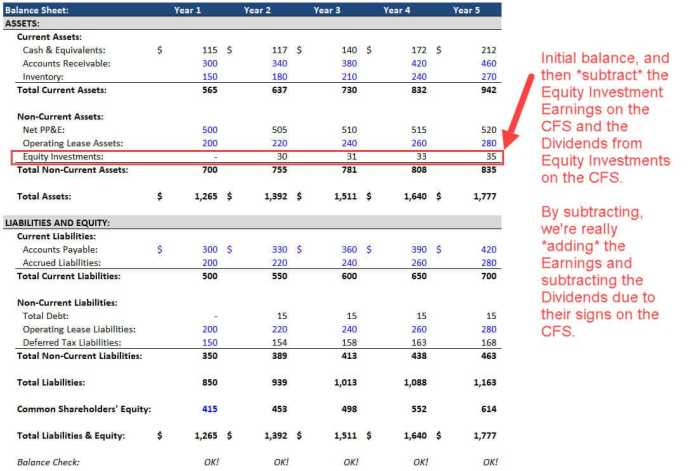

Adjustments and Consolidations

When applying the partial equity method, the parent company must make adjustments to the subsidiary’s financial statements to account for its ownership interest.

These adjustments include:

- Eliminating intercompany transactions and balances

- Adjusting the subsidiary’s net income for the parent’s share of undistributed earnings

- Adjusting the subsidiary’s retained earnings for the parent’s share of undistributed earnings

These adjustments ensure that the parent company’s financial statements accurately reflect its ownership interest in the subsidiary.

Advantages and Limitations

The partial equity method has several advantages, including:

- It is relatively simple to apply.

- It provides a more accurate measure of the parent company’s income than the cost method.

- It is consistent with the consolidation method, which is used to prepare consolidated financial statements.

However, the partial equity method also has some limitations, including:

- It does not recognize income from the subsidiary until the subsidiary declares and pays dividends.

- It can be difficult to apply if the parent company does not have a controlling interest in the subsidiary.

General Inquiries: Under The Partial Equity Method The Parent Recognizes Income When

What is the partial equity method?

The partial equity method is an accounting method that is used by a parent company to account for its investment in a subsidiary. Under this method, the parent company records its share of the subsidiary’s net income or loss as income or loss on its own income statement.

When does the parent company recognize income under the partial equity method?

The parent company recognizes income under the partial equity method when the subsidiary earns net income.

What is the significance of the parent company’s percentage of ownership in determining income recognition?

The parent company’s percentage of ownership in the subsidiary determines the amount of income that is recognized. The higher the percentage of ownership, the greater the amount of income that is recognized.